Setting up an E-commerce Company in Singapore

Due to the increasing cost of infrastructure and corporate maintenance many business owners are turning to the world of online commerce.

Below we have outlined some of the steps to successfully start your own online business:

Step 1: Research and Planning

- Conducting initial market research is an essential first step to give you an idea about your target market, how to access them and to assess the expected demand for your product or service;

Your initial research should typically answer questions such as:- Who will be your buyers?

- Where and how you’re going to obtain your products?

- What are you doing to fund your business and what is your plan B?

- Who are your competitors and what is your competitive advantage?

- On the other hand, drawing your business plan will be your roadmap which will help bring your ideas and thoughts together. A business plan is crucial in determining what to prioritize and how to effectively reach new customers.

Step 2: Funding & Financial Assistance

E-commerce businesses have access to a variety of different funding and financial instruments to help grow their businesses.

Below are 3 main types of funding:

The old school-business loans | • A straightforward way to get more money to fund your business • Comes with a huge risk and cost of losing not only your business but also your capital if things do not work as per the plan. |

Investors | • Contrary to the traditional loan, this does not require the repayment of the principal amount in its monetary value. • As an exchange for the investment in your business, the investors claim a part/ share of your business. |

Government Funding | • Several initiatives allow start-ups and specific industry businesses to have access to the funds. • Grants, business incubator schemers, and tax incentives are few such initiatives. |

Step 3: Choosing the right Business Structure for Singapore Business

- E-commerce entrepreneurs can consider using one of the following business structures:

- Sole Proprietorship (SP)*

- Limited Liability Partnership (LLP)*

*Available only to Singapore citizens, permanent residents or Entrepass holders.

- An overseas company looking to set up in Singapore can use one of the following business entities to register a local presence in Singapore:

- Branch Office

Step 4: Incorporate your business

To open a business in Singapore, the 5 minimum requirements are:

Step 5: e-Commerce Infrastructure

Once your company is successfully registered, the next step is to consider what tools and infrastructure you may need to build your e-commerce business.

Below are some key things that every online business needs:

- A domain name: This is the name of your brand. Make sure you pick a domain name that represents your identity and is easy to remember. You can use domain providers such as GoDaddy or Vodien to register your domain.

- Website hosting: A hosting site will ensure that you have good security, bandwidth and that your site will be up and running all the time. Often domain providers also providing website hosting services.

- Web design: Your website is the face of your business. Make sure the design is user-friendly and provides adequate information to the user about your product. Many entrepreneurs leverage templates and tools from Shopify and Amazon to quickly and easily build their online stores.

- Marketing and advertising: A strong marketing plan is essential to ensure that more people find out about your business. Many e-commerce entrepreneurs leverage social media platforms and other paid online marketing channels to advertise their services and products.

- Payment Gateways: These are solutions that allow e-commerce sellers to collect payments from their customers in many different ways other than cash or bank transfer, such as by credit cards or digital wallet payments.

Step 6: Bookkeeping and Accounting

Bookkeeping and accounting is a mandatory requirement of any incorporated company.

Due to the high volume transactions many e-commerce businesses choose to leverage accounting software to help automate much of the accounting and bookkeeping requirements for their businesses.

Accounting and inventory management software like Xero and A2X (for Shopify & Amazon sellers) can help to easily keep track and reconcile sales invoices, expenses and bank transactions.

Step 7: Tax compliance

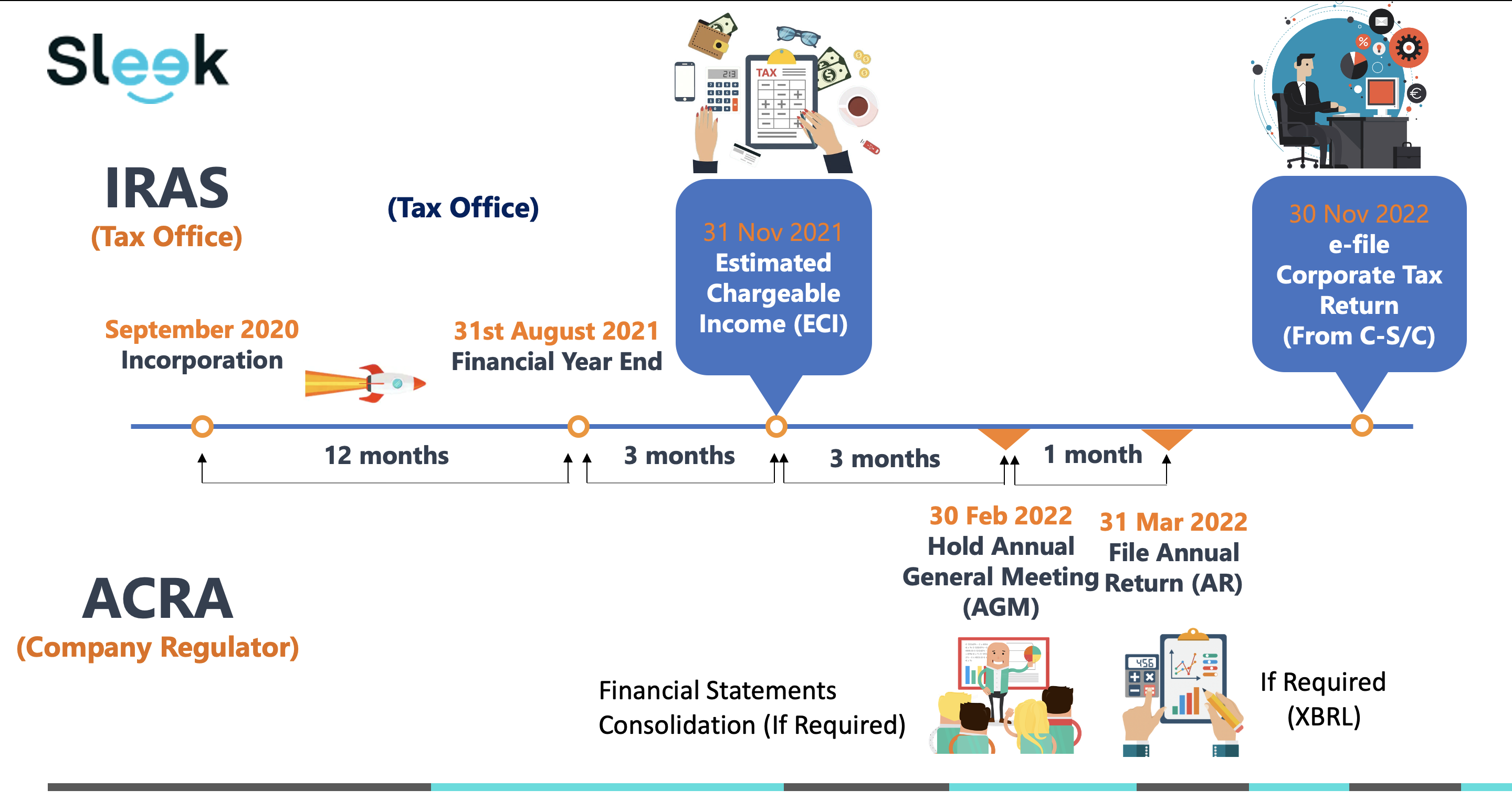

All Singaporean incorporated companies must adhere to the reporting standards set by the Inland Revenue Authority of Singapore (IRAS) and the Company Regulator ACRA.

Whether your Singapore company is active or dormant, all tax filings are compulsory. Failure to meet these deadlines can lead to fines and penalties including debarment of directors.