Important deadlines for my company

After the incorporation, there will be some important deadlines for your company.

Statutory Deadlines

-> Corporate Secretarial:

- AGM: within 6 months from end of FYE

- AR: within 7 months from end of FYE

- In addition, if there are any change of particulars, please inform us as soon as possible as the change has to be filed within 14 days.For all other transactions, the filing deadlines vary according to the Companies Act but generally it is within 14 days for most transactions.

-> Tax:

- ECI: within 3 months from end of FYE (unless exempted)

- Tax filing: For each financial year, the tax return is due the following year around 30 November

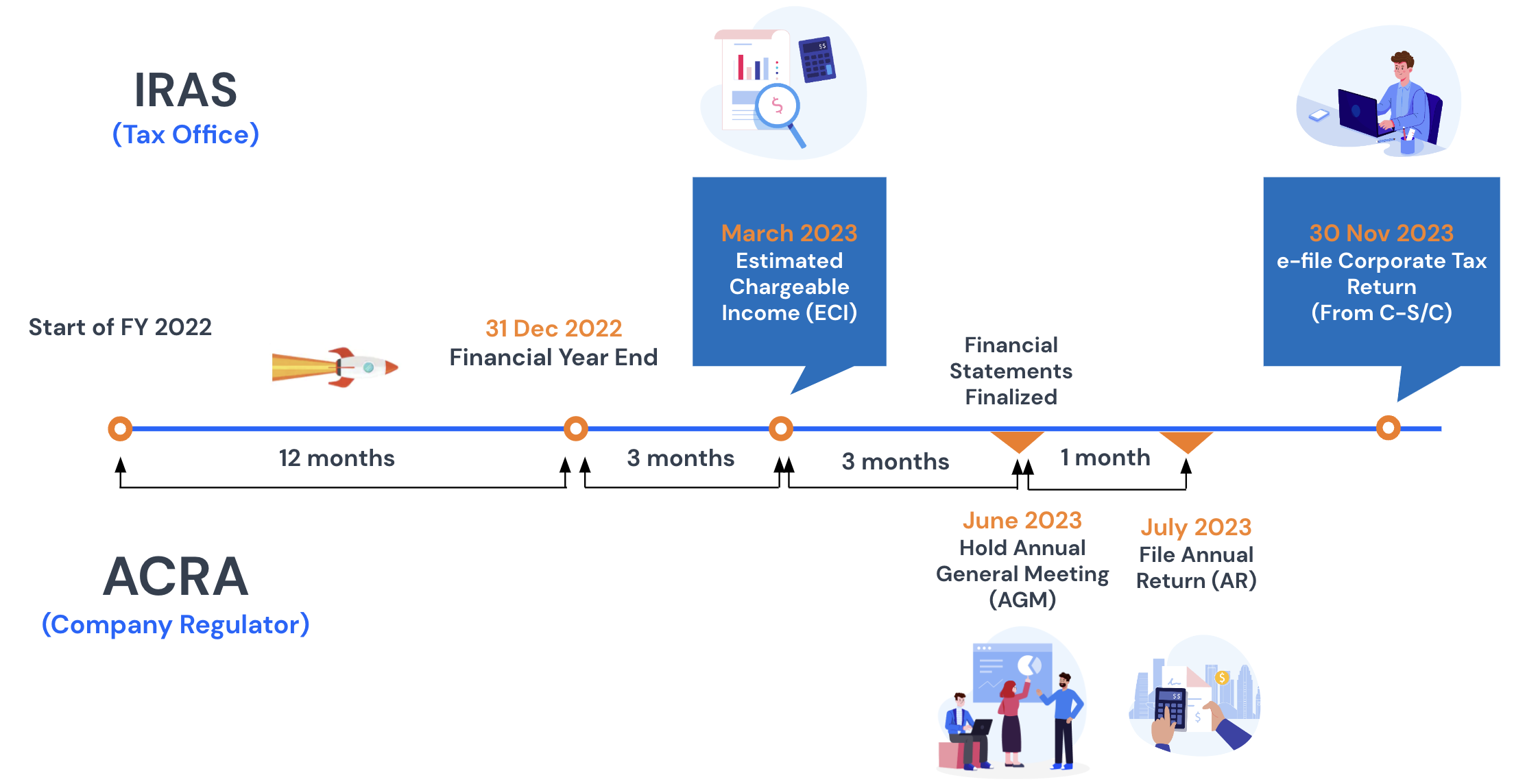

To explain it better, let's take Company A as an example:

Company A was incorporated in January 2022.

- Within 12 months after the incorporation, 31st December 2022 will be the Financial Year End (FYE) of the company.

- Within 3 months after the Financial Year End, 31st March 2023 will be the deadline for Estimated Chargeable Income (ECI) to be filed with IRAS.

- Within 6 months after the Financial Year End, 30th June 2023, Company A must hold the Annual General Meeting (AGM). It needs to prepare the Financial Statements for the AGM.

- Within 7 months after the Financial Year End, 31st July 2023, Company A needs to file the Annual Return (AR).

- 30th November of the year following the financial year end (in this case 30th Nov 2023), Company A needs to e-file the Corporate Tax Return (form C-S/C).

How Sleek can help

Do the above deadlines sound complicated? Don't worry! Sleek will offer help on the above deadlines for your company.

- If you subscribe to one of our accounting plans, we will prepare the following documents for you:

- Tax computation for ECI

- Form C-S/C for the Corporate Tax Return

- Financial statements in preparation of the AGM

- If your company fulfills the criteria for audit exemption, we will prepare the Unaudited Financial Statements (UFS) for you

- If your company doesn't fulfill the criteria for audit exemption, we will liaise with your auditor who will prepare the Audited Financial Statements for you

- If your company controls one or several subsidiaries, we can assist you to prepare the Consolidated Financial Statements for you

- If Sleek is your Corporate Secretary, we will also prepare the resolutions for the AGM and file the Annual Return for you.