Sending Money

Guides

Sending Local and International Transfers

Countries and Currencies

What currencies can I send to and from?

You will be able to create 12 different currency wallets ( SGD, USD, EUR, GBP, AUD, HKD, CAD, JPY, NZD, NOK, SEK & CHF ) and send money from those wallets.

Which countries can I send to?

Any other corridors that Sleek decides to prohibit are subject to its sole discretion.

Transaction Limits

What are the transaction limits?

Please note that there is also a transaction limit of SGD 200,000 per outgoing transaction via local routes for SGD within Singapore.

There is no transaction limit for incoming transactions.

Charges may apply per transaction. See here for fees and pricing.

Local transfer

What methods of local transfer does the Sleek Business Account support?

2. MEPS (incoming and outgoing)

3. IBG (incoming only)

4. PayNow (outgoing only)

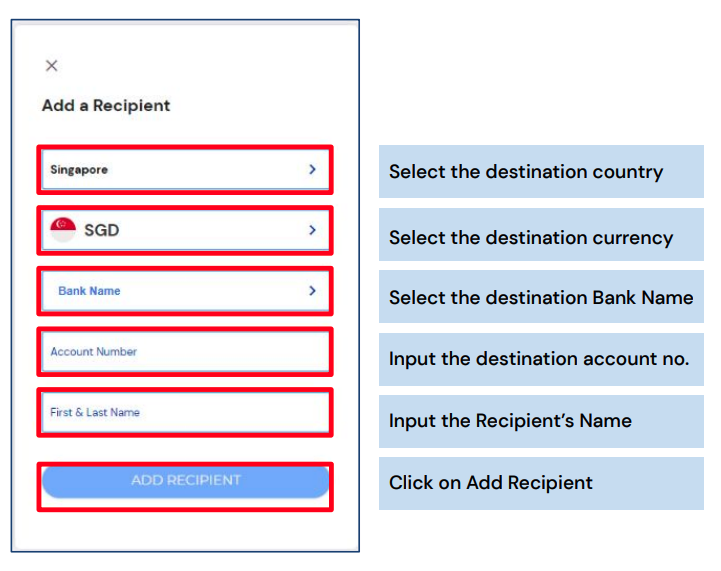

How do I add a new recipient?

What are the local transfer fees?

What is the processing time for local outgoing/incoming payments?

For local transactions via MEPS, transactions will be reflected in your Sleek Business Account within 1-2 working days.

For local IBG transactions, transactions will be reflected in your Sleek Business Account within 3-5 working days.

For local non-SGD transactions via the SWIFT network, transactions will be reflected in your Sleek Business Account within 3-5 working days.

Can I send funds via PayNow Transfer?

Other types of QR codes, such as PayLah QR, NETS QR, and others, are currently not supported.

How do I transfer funds via PayNow from my Sleek Business Account?

2. Click on the 'Pay via PayNow' button on your dashboard.

3. Select your preferred PayNow payment method.

4. Follow the on screen instructions to complete your payment.

Can I set up a Sleek Business Account for CPF contributions?

Direct debit via GIRO is not supported at this time.

Can I make GIRO payments?

In the interim, if you have recurring payments, using FAST could be a better alternative as you only need to add your beneficiary account number once in the Sleek Business Account web app and thereafter it is easy to make future payments. Furthermore, local transfer fees are absorbed by Sleek. You may refer here to learn how to add beneficiaries and send money.

Does the Sleek Business Account support Apple Pay or Google Pay?

Is the Sleek Business Account able to process Stripe payments?

International transfer

What methods of international transfer does the Sleek Business Account support?

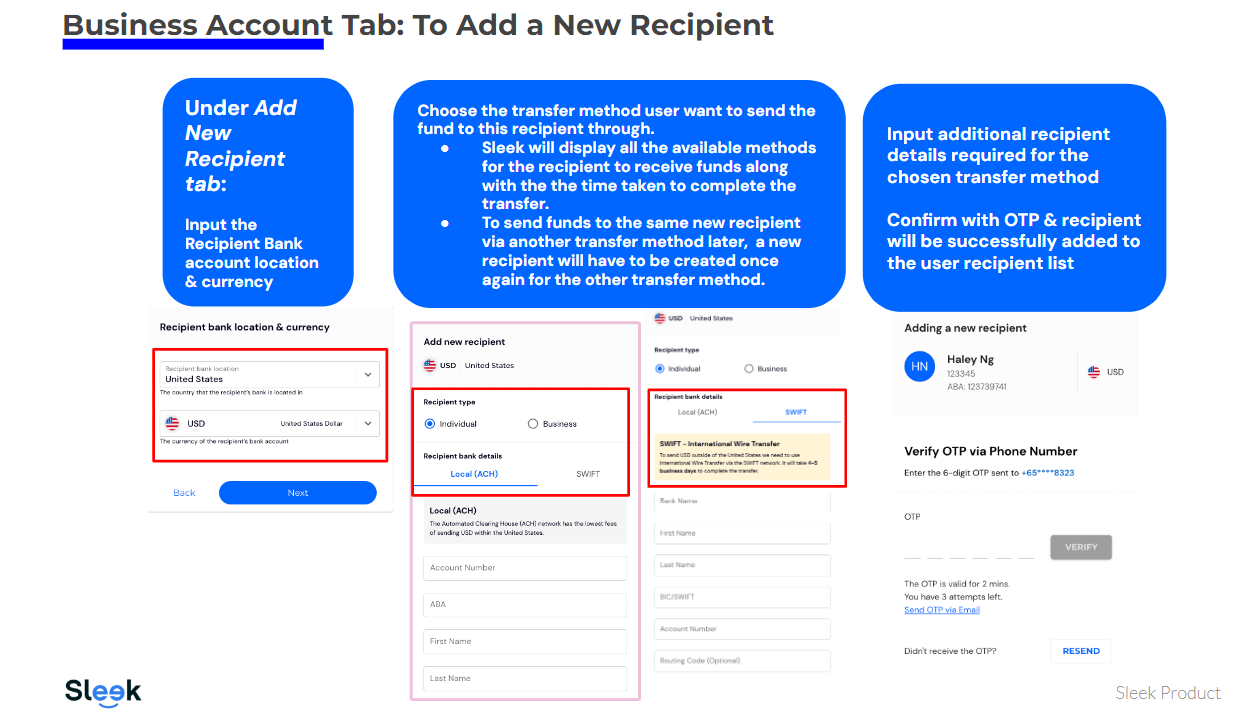

How do I add a new recipient?

What is the processing time for outgoing/incoming international payments?

Which countries are temporarily unavailable for outgoing international payments?

Why has my outgoing international payment been declined?

1. Incorrect Beneficiary Details

Please validate your beneficiary details before initiating the transfer again.

2. Insufficient Funds in your Sleek Business Account

An SGD 100 buffer is implemented to cover any additional charges charged by the intermediary banks. Hence, you will only be able to transfer the total balance in your Sleek Business Account less the SGD 100 for any international payments.

3. All outgoing international payments are made by Sleek Tech Pte. Ltd. on behalf of your company.

Due to certain countries'/beneficiaries' regulations, they might reject the transaction.

International transfers may be refunded for the following reasons.

If the transaction is from Sleek company to another bank,

1. Sort code is not correct.

2. Beneficiary bank is not stated correctly.

3. Account number is wrong.

4. Account Number format is incorrect.

5. Beneficiary bank and account number does not match.

6. You may have mistakenly sent money to prohibited/unsupported corridor.

7. Prohibited activities.

In the event your outgoing transaction is rejected/declined, the funds will be refunded back to your Sleek Business Account in SGD. It is possible that the amount differs from the initial funds that you sent out. This is may be due to fluctuating forex rates.

Fees and Pricings

SGD Transfer Within Singapore | |

SGD Transfer (Sending and receiving) within Singapore via FAST | S$0 |

Cross Border Transfer (Charged by Partner Bank) | |

Outward Telegraphic Transfer | |

Handling commission Handling commission, or handling charge, is a surcharge that the bank or remittance service provider levies on the money transferred overseas. As its name suggests, it covers the administrative cost of handling the transaction for you. | 0.125% (min S$10, max S$120) |

In Lieu Of Exchange (not involving foreign exchange) | 0.125% (min $S$10, max S$120) |

Cable Charges When you wish to transfer money from your bank account into an overseas bank account, the bank needs to make contact with the receiving bank. The time and effort to make contact with the receiving bank is accordingly chargeable as a cable charge. It is almost akin to the fees you must pay when you call your overseas friend on your telco post-paid plan. The cable charge is typically a fixed fee per transaction, set by the bank or money transfer service provider. | Approximately S$20 |

Agent Charges There will always be a receiving bank in an overseas money transfer transaction. The receiving bank is also known as the agent bank. The agent bank will need to liaise with your bank or money transfer service provider to accept and complete the transaction. For these efforts, the agent bank charges a fee. | If Applicable (Approximately S$20) |

Amendment / Tracer Charges Charges apply for each tracer/amendment(e.g. incorrect beneficiary name or account details) | S$30 |

Additional Miscellaneous Costs Charges depend on various factors(e.g. agent bank fees or transfer amount) | Dependent on transaction |

Outgoing SWIFT transactions Overseas transfers | Processing time of 3-10 working days |

Cancellations and refunds

I would like a refund for something I bought.

Do note that point of sale transactions cannot be reversed. If you authorise a transaction and then fail to make a purchase of that item as planned, the approval may result in a hold of funds equal to the estimated purchase amount, for up to seven (7) days.

You might also want to visit: